You’ve just dipped your toes into the world of trading and you’re eager to learn the ropes. “Best Chart Patterns For Beginners” is your guide to understanding the most essential chart patterns that can help you make more informed trading decisions. You’ll discover patterns like the Head and Shoulders, Double Tops and Bottoms, and Flags and Pennants, all designed to give you a solid foundation. To fast-track your learning, consider enrolling in my comprehensive Forex Trading Udemy course. It’s tailored for beginners and will provide you with the tools and insights you need to trade with confidence. Have you ever looked at a stock or forex chart and felt like you were staring at a jumbled mess of lines and bars? Trust me, you’re not alone. Many beginners find it challenging to decode these charts, but the good news is you can quickly get the hang of it if you start with chart patterns. Let’s dive into the world of chart patterns and discover some of the best ones for beginners like you.

What Are Chart Patterns?

Chart patterns are formations made by the price movements of a security or a currency on a chart. These patterns can tell a story about what the market is doing and help you anticipate what might happen next. Whether you’re into stocks, forex, or cryptocurrencies, understanding chart patterns can be your first step towards mastering market analysis.

Why Are Chart Patterns Important?

Chart patterns are like a road map for traders. They offer a visual representation of market sentiment, indicating periods of consolidation, breakout, or reversal. In short, they help you make informed decisions about when to enter or exit trades. Think of them as your trusty GPS in your trading journey.

And hey, if you’re interested in digging deeper into trading strategies, I can highly recommend my forex trading Udemy course. It’s packed with easy-to-understand tips that will accelerate your learning curve!

Foundational Patterns Every Beginner Should Know

Before you can become a chart pattern guru, you’ve got to start with the basics. Understanding foundational patterns can boost your confidence and provide a solid base for more complex trading strategies.

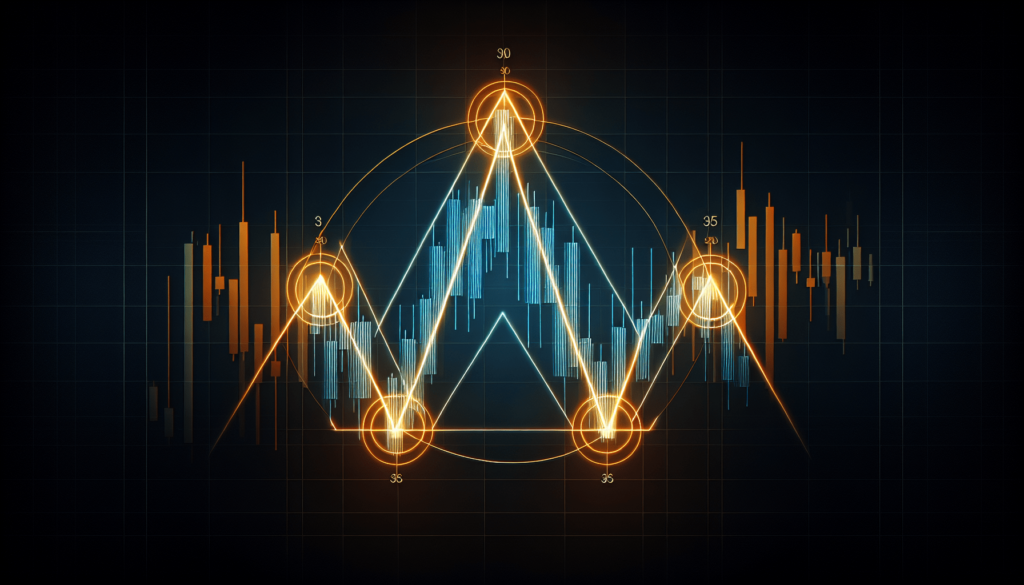

Head and Shoulders Pattern

This pattern looks exactly like it sounds—resembling a human head with shoulders on either side.

- Head: The highest peak in the middle

- Shoulders: Two slightly lower peaks on either side

- Neckline: A line that connects the low points of the shoulders

When the price breaks below the neckline after forming the right shoulder, it often signals a reversal. It’s like the market is shrugging off an upward trend to make way for a downward one.

Double Tops and Bottoms

These are also straightforward patterns:

- Double Top: It looks like an “M” on the chart. After hitting a high price twice and failing to break higher, the price typically drops.

- Double Bottom: This one resembles a “W.” It forms when the price hits a low twice but can’t go lower, often signaling an upward move.

Flags and Pennants

Although they are shorter-term continuation patterns, flags and pennants can be incredibly effective.

- Flag: Appears as a small rectangle slanting against the prevailing trend.

- Pennant: Looks like a tiny symmetrical triangle.

Both patterns indicate brief pauses in the market before continuing in the original direction.

Intermediate Chart Patterns for Growing Traders

Once you’ve grasped the foundational patterns, you can step up your game with some intermediate ones. These patterns can offer more comprehensive market insights and potentially higher rewards.

Symmetrical Triangles

This pattern shows a market that is in a state of indecision, forming a triangle shape:

- Converging trendlines: Connect the series of lower highs and higher lows.

- A breakout can occur in either direction, often leading to a strong move.

Ascending and Descending Triangles

These are variations of the symmetrical triangle but lean in favor of a particular direction.

- Ascending Triangle: Flat top and rising bottom trendline. Breaks upward more often than not.

- Descending Triangle: Flat bottom and a descending top trendline. Likely to break downward.

Cup and Handle

Resembling a teacup, this pattern signifies a bullish continuation and comprises two parts:

- Cup: A rounded bottom

- Handle: A small downward consolidation

When the price breaks above the handle, it usually leads to a bullish move.

Wedges

There are two types of wedge patterns — rising and falling. They can indicate a reversal or continuation, depending on their context.

- Rising Wedge: Bearish pattern, marked by rising lower highs and higher highs converging.

- Falling Wedge: Bullish pattern with descending lower highs and lows converging.

How to Confirm Patterns

Recognizing a pattern is one thing, but confirming it is crucial for making successful trades. Here’s how you can do that:

Volume Confirmation

- Increasing Volume: This typically supports the breakout direction.

- Decreasing Volume: May signify potential false breakouts.

Technical Indicators

Employ indicators like Moving Averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) to add an extra layer of confirmation.

Timeframes

The validity of patterns can vary across different timeframes. Make sure your chosen timeframe aligns with your trading strategy.

Common Mistakes to Avoid

Trust me, everyone makes mistakes when starting out. The important thing is to recognize and learn from them.

Overcomplicating

Trying to identify too many patterns can overwhelm you. Stick to a few initially and master them.

Ignoring Market Conditions

Not all patterns work in every market condition. Always consider the broader context.

Lack of Discipline

A profitable strategy requires discipline. Stick to your trading plan and avoid emotional decisions.

Practical Tips for Pattern Trading

Keep a Trading Journal

Document your trades, patterns, and outcomes. Reviewing this can provide invaluable insights and help you refine your strategy.

Backtesting

Test your identified patterns using historical data to evaluate their effectiveness before putting real money on the line.

Stay Updated

The market is dynamic, and even seasoned traders need continuous learning. Follow valuable financial news sources, and don’t hesitate to take advantage of more structured learning platforms.

Speaking of structured learning, my forex trading Udemy course can guide you through practical applications of these patterns. You’ll learn not just how to identify them, but also how to implement them into winning trading strategies.

Use Demo Accounts

Especially if you’re new, practicing on a demo account can build your confidence. You get to make mistakes without risking your hard-earned money.

Tools to Enhance Your Chart Pattern Analysis

In this digital age, you’ve got a variety of tools to streamline your trading efforts.

Charting Software

Platforms like TradingView, MetaTrader, and ThinkorSwim offer tons of features to help you identify and analyze patterns more effectively.

Mobile Apps

Many brokerages offer mobile apps that let you monitor and analyze patterns on the go. They provide the convenience of trading anytime, anywhere.

Trading Communities

Forums and social media platforms can be gold mines for tips and real-time information. Engage with other traders to broaden your horizons.

Conclusion: Take the First Step

Mastering chart patterns is not an overnight task, but it’s an incredibly rewarding investment in your trading future. Armed with this knowledge, you’re well on your way to making more informed trading decisions. Remember, it’s not just about spotting patterns, but interpreting and confirming them to suit your trading strategies.

And if you’re looking for an edge, consider checking out my forex trading Udemy course. It’s designed to take you from pattern recognition to executing profitable trades.

So, what are you waiting for? Dive into the world of chart patterns and start refining your market strategies today!